Overview

The 25C tax credit was recently extended for 10 years, through 2032. The 25C provides a credit to homeowners for installing certain energy-efficient insulation, windows, doors, roofing, and similar energy-savings improvements.

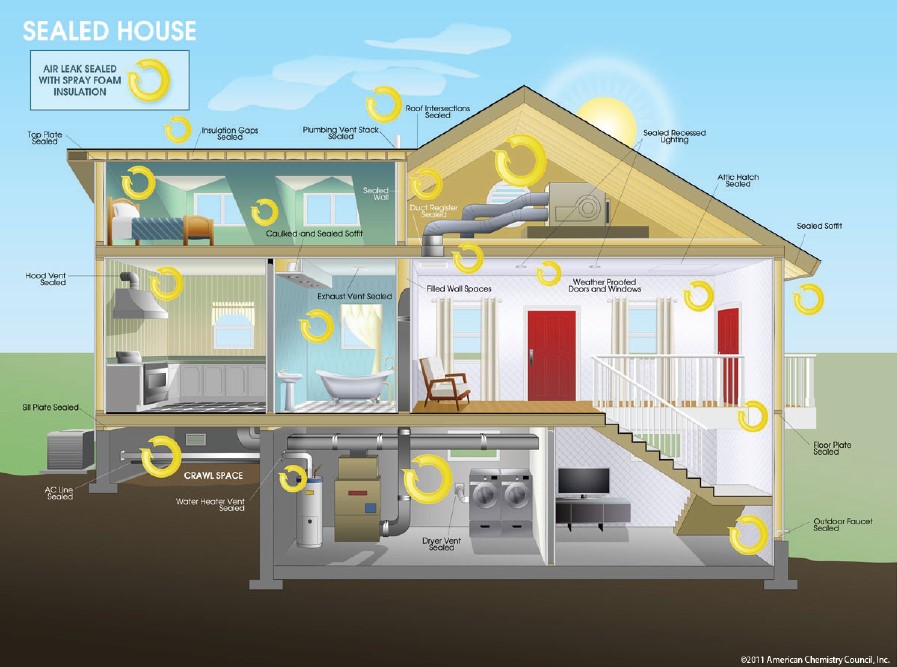

Spray foam is an all-in-one insulation that provides thermal performance along with a moisture and air barrier. Because of spray foam’s air barrier, homes retrofitted with spray foam can save more energy than other forms of insulation installed without additional air sealing.

2022

The Inflation Reduction Act extended the original version of 25C through 2022. 10% of the costs of a qualifying energy efficiency upgrade or $500, whichever is lower.

2022 applications have to comply with the 2009 IECC.

2023

Beginning on January 1, 2023, the expanded 25C will provide a 30% tax credit (up to $1200 annually) to consumers who take certain steps to make their homes more energy efficient.

- The expanded 25C also provides that air sealing materials can qualify for the credit. This is important because air sealing and insulation work together to maximize energy savings, which is why the EPA Home Performance with Energy Star program recommends that, for example, the attic floor be air sealed before installing more insulation.*

2023 applications have to comply with the 2021 IECC.

Benefits of Building and Retrofitting with Spray Foam

Spray foam can provide numerous climate, energy-efficiency and structural benefits to homes:

- Homes insulated and air sealed with spray foam can increase comfort by keeping temperatures steady and preventing moisture and humidity build-up.

- Spray foam can make homes more durable by helping keep the roof in place during high winds and preventing water from seeping through weak spots.

- Spray foam can help create more energy-efficient homes by sealing gaps and holes that cause air leakage. This helps reduce the amount of energy needed to heat and cool a home, thus reducing the carbon footprint.1 Existing homes that are retrofitted and air sealed with spray foam can save up to 20% in energy costs, depending on the amount of existing insulation and climate zone.2 By sealing gaps and holes that cause air leakage, homes that are insulated and air sealed with spray foam generally use less energy.

Homeowners can apply for the 25C tax credit by filling out IRS Form 5695, Residential Energy Credits, while doing their federal tax return. For information about the Form 5695 or to find the actual form, visit: www.irs.gov/forms-pubs/about-form-5695. Supporting documentation may include a notice provided by contractors that, after installing the additional insulation, the attic or wall meets the R-value recommendation in the 2021 IECC model energy code for the home’s climate zone and an invoice.

* Insulation upgrades must comply with the 2021 IECC, so the homeowner may need to add sufficient additional insulation to meet the 2021 IECC R-value recommendations for the climate zone where the home is located to qualify for the tax credit.